The eternal issue of how to price software licensing weighs heavy on product teams around the world.

In fact, the 2023 Monetization Monitor revealed only 32% of software suppliers believe their pricing is “totally aligned” to value, highlighting the extent of this pivotal challenge.

The risk is obvious: If your customers and prospects don’t see value for money, the success of your business hangs in the balance, so it’s crucial to constantly review feedback, analyze data, monitor the market, and make every attempt to ensure the price is right.

Fortunately, you can remove the guesswork from product management by taking a data-drive approach to key decisions, including those on how to price software licensing.

Gates Way to Success

Way back in 1999, in his manuscript titled Business @ The Speed of Thought, Bill Gates wrote:

“The most meaningful way to differentiate your company from your competition, the best way to put distance between you and the crowd, is to do an outstanding job with information. How you gather, manage and use information will determine how you win or lose.”

This philosophy helped propel Microsoft into the multi-billion-dollar behemoth it is today, and it’s one that every product leader should bear in mind.

Ultimately, your best source of information will always be your customers, both in terms of what they say and – crucially – what they do.

As such, decisions on how to price software licensing should consider:

- Quantitative data: Usage reports allow you to measure feature adoption and utilization, providing objective insights into value drivers, product positioning, and potential bottlenecks.

- Qualitative data: Direct input from important clients who can provide feedback on valuable features, preferred billing models, packaging options, desired enhancements, etc.

A commitment to combine these methodologies will ensure a rounded picture on customer priorities, empowering you to sell your solution in a manner that represents true value.

Observation Mode

When it comes to spotting patterns and identifying opportunities, software suppliers have the ability to unleash a dynamic secret weapon in the form of product usage analytics.

Usage data provides unbiased information on how your products are being used, allowing you to track behavior to determine key features that drive the most value and where licensing models can be adapted – perhaps to focus on metered pricing, for example.

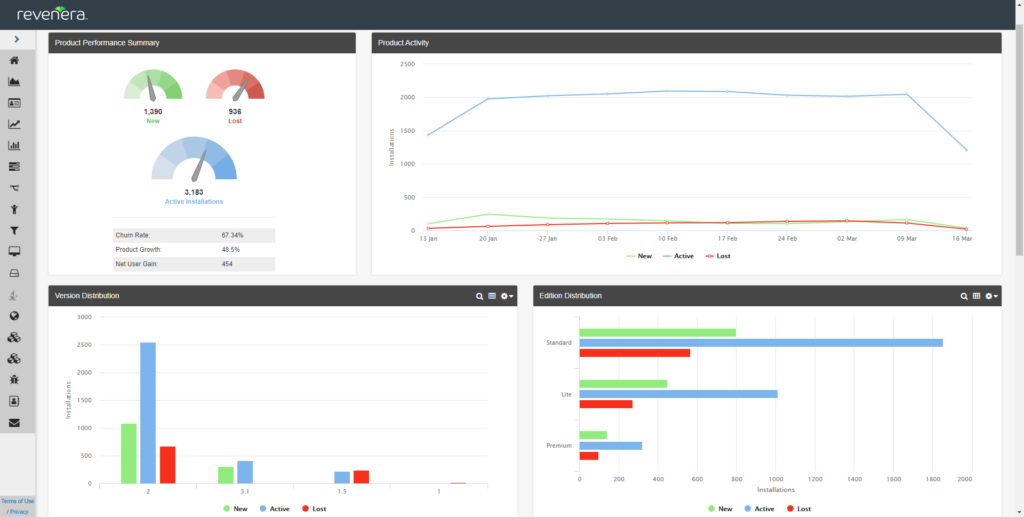

Example dashboard from Revenera Usage Intelligence

Studying these trends can also influence roadmap prioritization and deprecation, ensuring you focus on areas that people really care about, while also guiding SaaS transition projects – informing which functionality to retire when migrating on-premises products to the cloud.

Additionally, usage insights can help you tackle revenue leakage, shining a light on compliance issues, such as misuse and overuse, enabling you adjust pricing and negotiate upgrades where necessary.

Furthermore, analyzing behavior can highlight where users get stuck during free trials, allowing you to create email nurture campaigns or in-app messaging to keep people on track, increasing the likelihood of conversion.

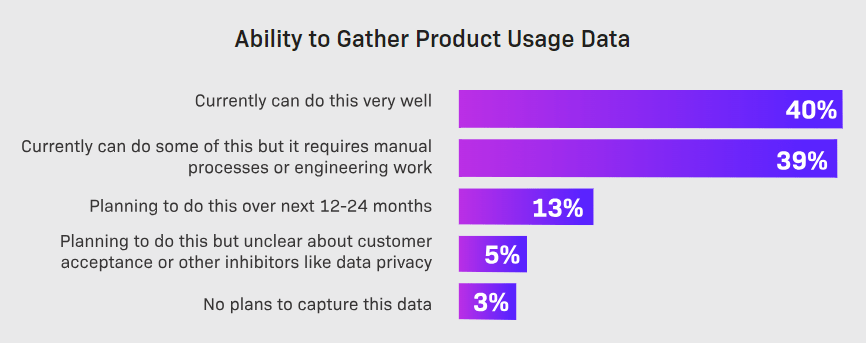

With the potential to strengthen multiple business models, it’s no surprise that the vast majority of software producers either currently collect or are planning to collect usage data, with only 3% stating they have no intention to do so according the 2023 Software Usage Analytics report.

However, only 40% of those who currently collect usage data believe they do so “very well,” so there’s plenty of room for improvement.

After all, collecting information is one thing, but how you act on it is another.

Listening Mode

For qualitative insights, you can study usage data to segment your audience and approach different groups with relevant questions.

For example, you can quiz your most active customers on how and why the use your product and the outcomes they achieve – essentially getting to the root of how they measure value.

The aim should be to forge a true partnership, gaining ideas and gauging reactions from engaged parties who have a vested interest in mutual success.

Some organizations arrange ‘sourcing the gold’ sessions, inviting power users to meet with product management, engineering, and support staff, working together to ask questions and build new feature requests as part of a comprehensive revenue optimization strategy.

By exchanging thoughts on feature functionality and where value is created, you’ll gain insights into potential bundling and packaging options, while also having the opportunity to discuss subscription models and service level agreements – all of which can inform pricing decisions.

Conversely, you can also approach less engaged users to understand why they don’t use certain features, potentially uncovering UI/UX or onboarding problems that could be resolved with redesigns or updated documentation.

How to Price Software Licensing with Data

Traditionally, go-to-market strategies have partly been informed by the psychological art of pricing, but software suppliers now have the ability to access so much product usage data that decisions can be more scientific.

While there isn’t a universal formula for how to price software licensing, gaining visibility into usage can help drive initiatives that grow Annual Recurring Revenue (ARR), adding context to subjective customer feedback.

To boost retention and acquisition, you need to build trust, and the best way to do so is by making informed choices based on analytics that help you quantify value.

Speaking of which, Revenera’s software licensing solutions help technology companies with the following benefits:

- 5-15% reduction in revenue leakage (overuse and misuse)

- 2-5% increase in channel sales via shared access to data

- 1-5% savings due to electronic delivery and updates

- 1-3% decline in support calls, with fewer licensing issues

- 1-3% boost in license renewals

If you need advice on how to price software licensing, our expert team can offer guidance on the latest software monetization models, implementation best practices, and how to overcome common barriers to revenue growth, so please contact us today.

You may also find value in our Ikon Science and Infor F9 case studies that demonstrate how to create new revenue streams by introducing modern software licensing models.